Published and Working Papers

Work in Progress

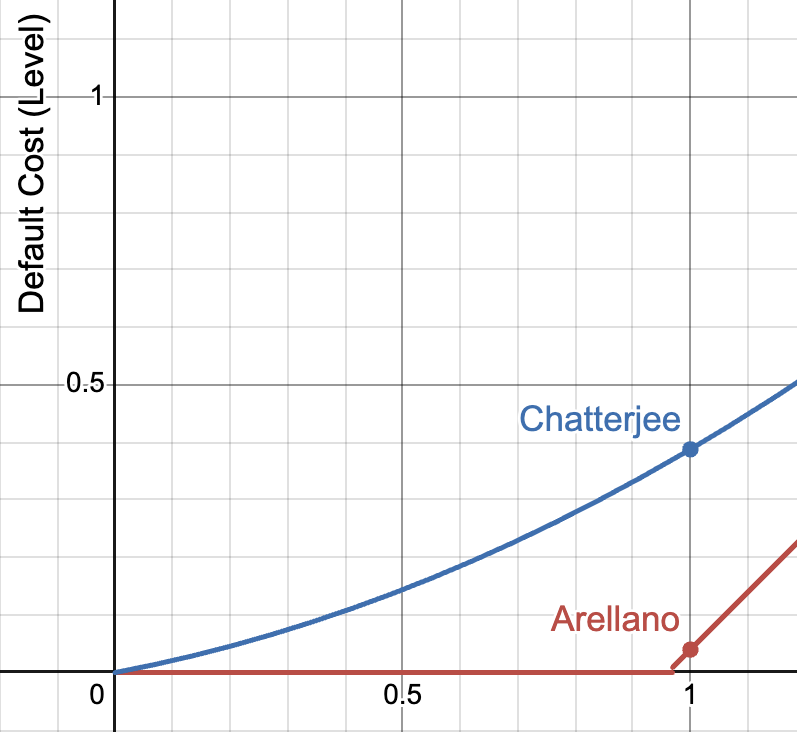

The Structure of Sovereign Default Costs: Theory and Evidence

with Venance Riblier

Arellano-style sovereign default models require that default involves a direct cost to GDP that is much more painful in good times. We test this hypothesis for the 2014 Argentine sovereign default, where default was a response to an exogenous US Supreme Court decision. We do not find asymmetric default costs in the data. We then develop a general model of default costs that suggests only a narrow set of conditions would lead to the asymmetry needed for modern default models to work, and that these conditions are rarely met empirically.

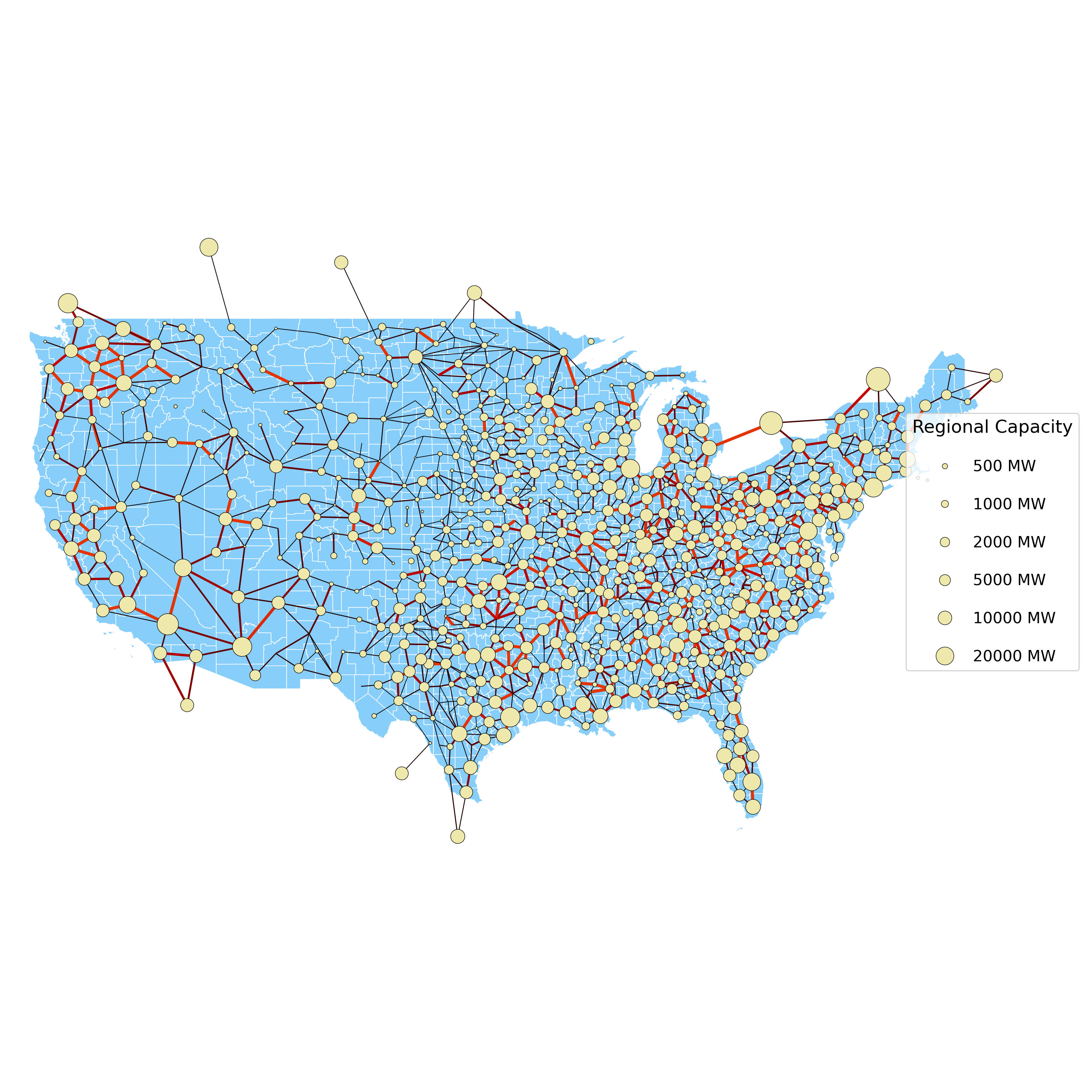

Optimal Electricity Grids

with Costas Arkolakis and Conor Walsh

Pre-existing work on spatial models with electricity grids take the transmission grid as exogenous. We endogenize the grid in a planner's problem using an Armington style model with energy inputs to production. We show how it is possible to convexify the problem to make it tractable. Using data on planned improvements to the European Union grid and electricity grid data from Open Street Map, we show that optimal grids dramatically improve welfare above and beyond existing lines and beyond these intended changes.

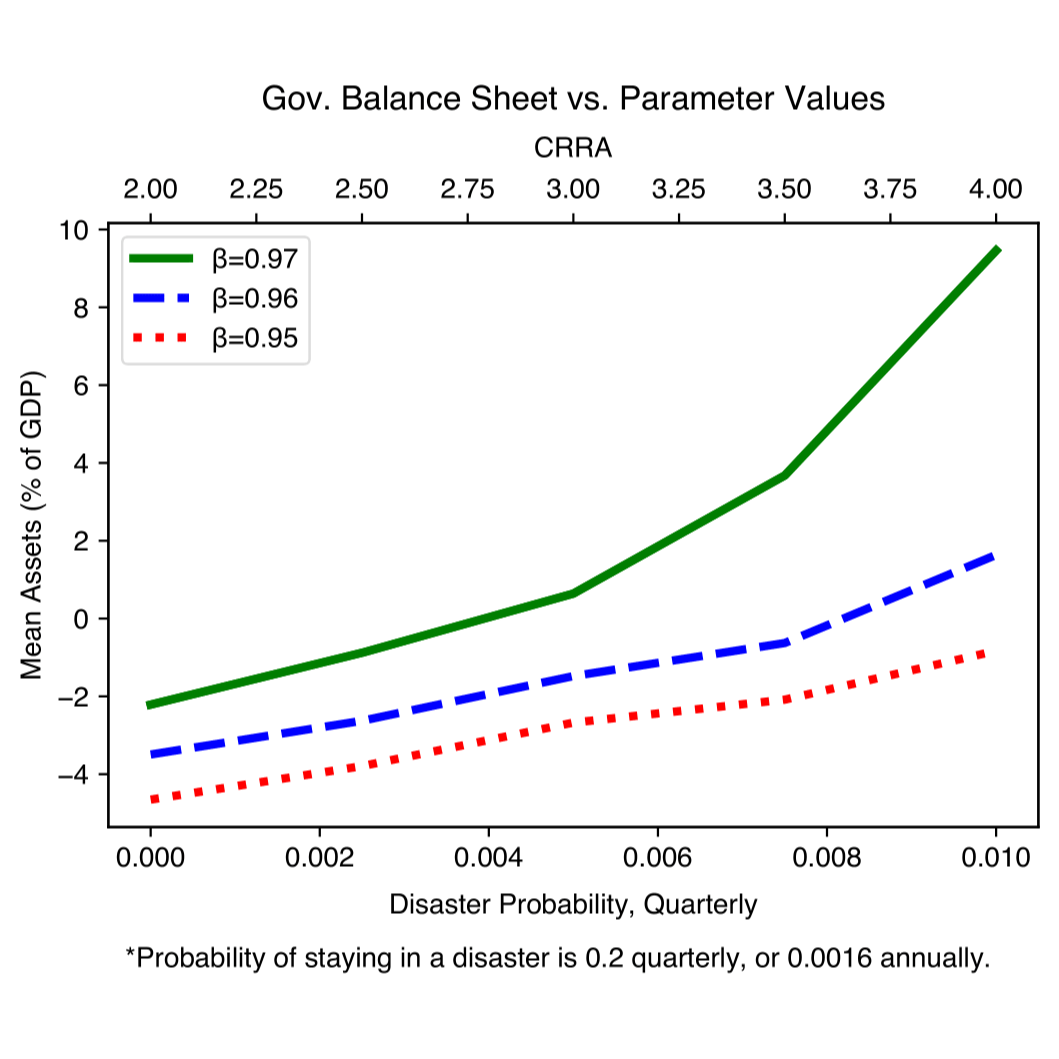

Sovereign Default, Lucas Welfare and the Equity Premium - A Puzzle

with Venance Riblier

The sovereign default literature argues that smoothing consumption is the primary motivation for a sovereign nation to borrow. We show that this is not true in standard models. Implementing canonical solutions to low welfare costs of fluctauations or the equity premium puzzle raises the precautionary savings motive of the sovereign dramatically, eliminating borrowing altogether in short-term debt models, and reducing borrowing in long-term debt models.

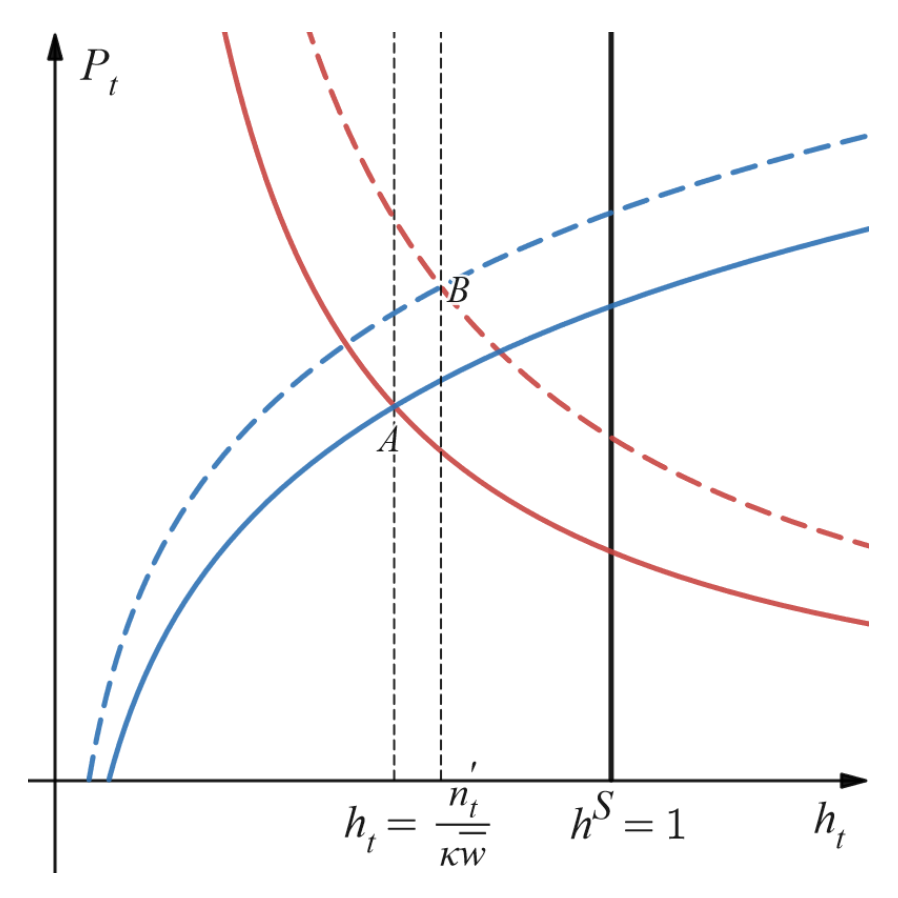

Bank Bailouts vs. Demand Stimulus - Fiscal Policy in Financial Crisis

with Venance Riblier

In the 2008 Financial Crisis, the US federal government implemented both troubled asset purchases and fiscal stimulus to smooth the business cycle. We develop a New Keynesian DSGE model with general financial frictions to evaluate the optimal mix of these policies for a given set of welfare criteria. The model allows for flexible implementations of various standard frictions such as liquidity crisis, lending constraints, and moral hazard. We find that, generally, fixing supply constraints ought to come first for cash-strapped governments.